A talk originally given as part of the 100th Commemoration of the Economics Course held by the Economics Conference of the Goetheanum.

I’m going to break up my presentation on blockchain into three sections. First, I will talk about its history. Then, I will focus on one of its components, which is known as a decentralized autonomous organization (DAO). And lastly, I will show an example of a DAO that has intuitively approached the associative economic paradigm.

A Brief History of Blockchain Technology

In historical terms, we arrive at a moment in history where economics and politics get entangled, specifically around who issues the tokens and who keeps the ledgers. The conflation of the economy and rights spheres is one of the root causes of the social unrest present throughout known history.

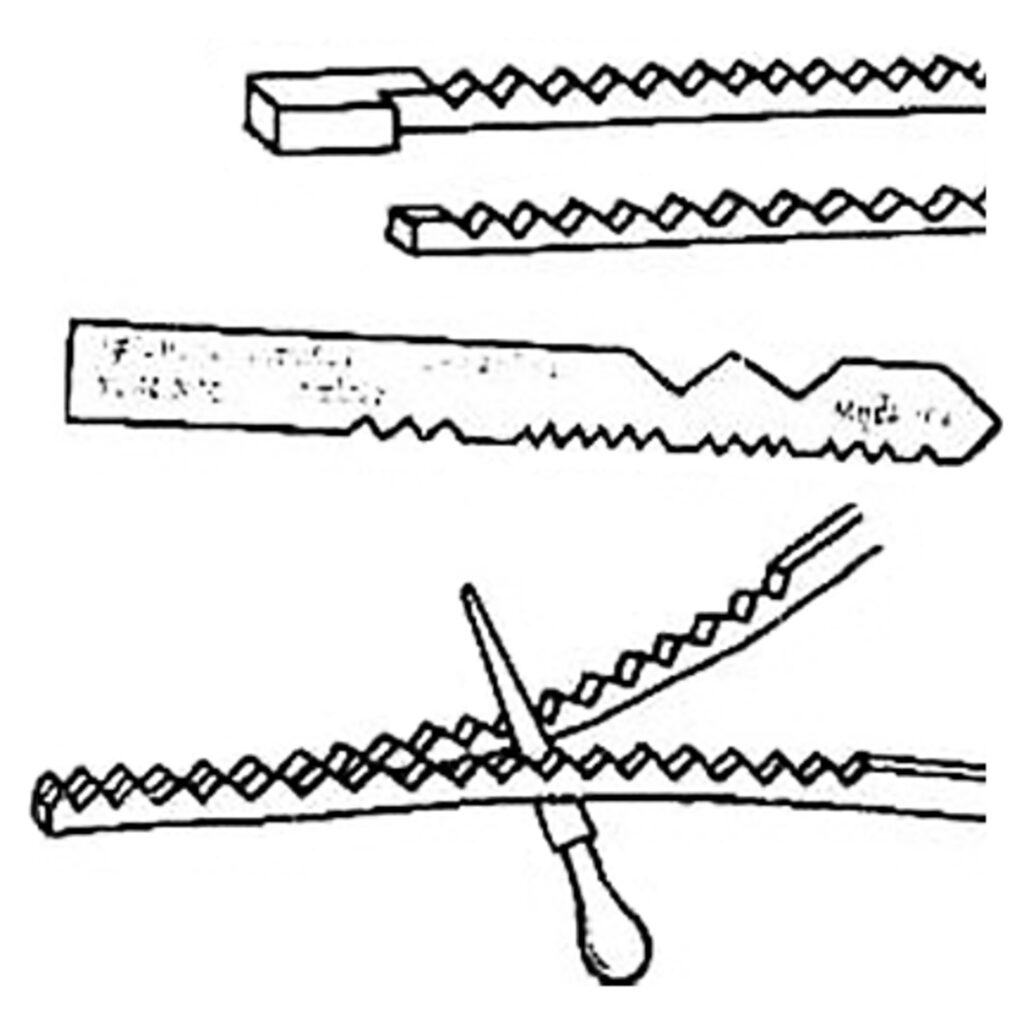

The tally stick was a practical solution to this problem of issuance and record-keeping and it can be interpreted as the analog precursor of the blockchain. The split tally stick had very similar characteristics to those of a data block in a blockchain, and it is the best example I could find to explain the blockchain in lay terms. Tally sticks were accounting instruments dating back thousands of years. The first ones were made of bones, later wooden sticks were used. They were used when two parties needed to record, by carving the sticks, all sorts of records; agreements, messages, transactions, etc. They ended up being mostly used to record transactions between known parties, without third-party intermediaries; which is what is known as a peer-to-peer transaction in blockchain terms.

All these dents are carved onto the stick, and then the stick is split longways into two halves. One half becomes a credit and the other a debit. The unique characteristics of the material and the unique nature of the split would guarantee the immutability of the carvings; only these unique two halves would fit perfectly. Reuniting them would act as a trial balance of sorts, or proof in blockchain terms. Tally sticks were widely used in China; eventually, they made their way to Europe. In middle age England, they became the instrument of choice to track taxation, and were adopted as an accounting method by the Bank of England.

Tally sticks are a close analog to a data block in blockchain, in essence, two immutable parts that uniquely match together. Now, when a tally stick made reference to another, a tally-stick-chain would start to form. And now, these linked tally stick chains become a close analog to a blockchain. The longer halves were known as stocks and were kept by the creditors, who eventually commoditized them into a form of money, creating the ‹stock exchange› to trade them. These sticks were actually both accounting and a form of money. So in the terms of the thesis of ‹money is accounting›, tally sticks literally embodied this thesis because they manifested accounting and money in the same instrument.

As an aside, the Bank of England once had a six century old tally stick-chain, acting as a reserve, stored in the basement of the Parliament Building, and when, in 1834, the Bank adopted paper notes, the oldest tally-stick-chain in the world was ordered to be burned. This effectively ended the immutable characteristic of the tally stick technology at the bank. Unfortunately, the burning got out of hand and the entire former Parliament Building was burned to the ground1. The new Parliament Building was then built on the same site.2

Fast forward to modern financial times, the conflation of the economic and rights spheres is institutionalized, creating much social agitation. At this point we find private and central banks issuing and regulating money for the public, while also holding the ledgers. Referencing Steiner’s 9th economics lecture, this conflation is bound to lead to an impersonal instrumentality in banking practices, a source of toxicity for society. It establishes an abstract separation between lenders and borrowers, who no longer know or see each other. When this took hold, banking acquired a permanent anti-social nature, working against the fraternal nature of economic life.

Now fast forward to recent decades, this instrumentality has evolved into highly sophisticated abstractions, which in 2007 triggered the subprime market crisis. At this point, some people started to perceive the conflation as collusion, a vulnerable point through which moral hazard3can creep in between political and economic life. The flaws of the instrumentality of banking gave rise to a social catastrophe and people began to explore ways to subvert the weak point. And that’s the general gesture from which blockchain technology arises – to get around the potential for collusion between the two spheres and to reinstate the peer-to-peer fraternal nature of economic life.

So then in 2008, just a year after the subprime crisis had started, the first practical distributed ledger ‹anonymously› emerged, the one known as Bitcoin. There were previous ones, but they were experimental and had a private club nature. Bitcoin was the first one explicitly created to prove that the vulnerable point could be bypassed. That was the only thing that Bitcoin intended to prove. Bitcoin is appropriately criticized for its flawed economics, but these criticisms would only be legitimate if Bitcoin’s original design had proposed a new economic model, which it did not. So that was 2008 and Bitcoin proved to be successful at bypassing the vulnerability point.

It’s been 14 years since Bitcoin’s inception and in that short period of time, it has recapitulated many of the milestones of financial history. Initially, Bitcoin was meant to be a payment system. Up until the early 2010s, you could still use Bitcoin to purchase a coffee, a pizza, whatever. So, for the first few years, you could use it as a peer-to-peer payment system, which was its only original purpose. Then it caught on, it became popular with those who became disenfranchised by the sub-prime crisis, and due to its immutable characteristics, it came to be perceived as a reserve currency.4 It has been perceived as gold, and since DeFi emerged (decentralized finance, described below) it has been packaged as a security and as collateral for other cryptocurrencies and projects.

So, in 14 years it has gone from a payment system (peer-to-peer transactions) to reserve currency (gold equivalent) to security (packaged for liquidity pools) to synthetic instruments (bonding curves). It has also recapitulated all the crashes and booms, and regulatory mends that conventional finance has experienced along the way through those same evolutionary steps. It practically mirrored the history of modern conventional finance (barter, gold rush, off the gold standard, derivatives, etc.).

Then in 2015, an improvement was invented: a full programmable language was layered over the distributed payment system. This allowed for contracts to be embedded by the parties in their peer-to-peer transactions. Since then, peers have had the freedom to create whatever conditional contracts they deem necessary, in a very simple manner. This layer is known as ‹smart contracts›, essentially programmable money configured by the transacting peers, who establish all the conditions to trigger a transaction and/or guide its clearing. It can be established by the two transacting peers or by larger groups of peers. Smart contracts give an important additional tool to blockchain technology, beyond the simple bypassing of the institutions that were viewed to be a problem. It brings peer-to-peer governance to the mix. So, while money implies accounting, accounting also implies governance – a new two-way picture that could bring about harmony to the paradoxical conflation of economic life and the life of rights. As per Steiner’s 3rd economic lecture, this conflation makes economics the most complex science of all, as it has to find harmony between ethical and theoretical worldviews.

In 2017, the first non-fungible tokens (NFTs) appeared. These merely act as titles to unique tangible or digital assets, hence why they are not fungible.5 A sort of a hybrid, a value token that also has rights towards an asset. For example, there are NFTs linked to real sources of value, like kilowatts generated by solar panel panels; others are linked to cars and houses; the more popular and dreadful ones are those linked to inane digital art. These are very popular right now, but are aberrations of its use, incompatible with the legitimate sources of value described in Steiner’s 2nd economic lecture; again a sort of a recapitulation of the Art Market’s boom and crash of the 1990s.

Then around 2019 came DeFi.6 Once more than one blockchain had been established, a marketplace to trade all these instruments was needed. DeFi stands for decentralized finance, which keeps evolving from the ‹by-pass› ethos, interconnecting peers from different networks so they can exchange their tokens in different ways, create new synthetic instruments, create additional ways to create value, store value, or transfer value. Again, another recapitulation of current conventional financial practices.

So, that concludes a quick history of the fourteen-odd years of this nascent technology, whose origin resembles the split tally stick technology of the Middle Ages.

Brief History of Economic Networks

Next, there are three crucial terms that help contextualize blockchains within the realm of networks. Tally sticks circulated in networks similar to the image below on the left, the ‹distributed network›. Tally sticks were freely created between peers and could be further exchanged via a very fluid and flexible network. Then, finance became instrumentalized via third-party institutions using ‹decentralized networks›, seen in the below central image, and then into ‹fully centralized networks›, in the likes of communist or totalitarian regimes (the right-hand image).

This shows an evolution of the economic network as it starts to conflate with the rights life – we have seen versions of all these three networks, from very early bartering to peer-to-peer, to super centralized. The centralized network is the image of the communist State, with one central bank administering everything and disconnecting everybody. Everything is done through the State and for the State; so that model resembles the image on the right side, showing a fully centralized network. The centre image shows a decentralized network, which resembles the modern conventional western financial model, where there are institutions that act as intermediaries between peers; and the image on the left shows a distributed network, where everybody can connect in freedom, without intermediaries.

So there appears to be an oscillating evolution, going from distributed networks to decentralized networks to fully centralized networks, and then back to decentralized, and then back to distributed, the peer-to-peer network. The type of economic network used has implications for how you see yourself in economic life. If you’re in a fully centralized network (right image), for example, you would not be able to really participate. You’re pretty much at a stagnation point; similar to what Mao’s China was like, a central point of friction paralyzing everybody. The distributed network (left image) offers the least friction and maximum freedom and flexibility. It’s more agile. For example, the German financial structure has thousands of small to mid-sized banks, which allows for the rapid flow of Capital at a community level. This allows Germany, a relatively small country compared to China, to remain competitive. The Chinese eventually caught on to this and implemented a distributed financial model in the late 1990s, which was instrumental in their exponential economic growth.

Another example is in Canada we find a classic (post-colonial) decentralized model with very few banks in the entire country. The USA is somewhat of a hybrid. It used to be highly decentralized, but there has been a constant trend to consolidate it into a decentralized model with a few central points. So that’s a visual evolution of centralized, decentralized, and distributed networks. The distributed model basically sums up the gesture of this technology – a means to regain the economic sovereignty of individuals, which had been abdicated to the State and third-party institutions as a result of the premature and misguided conflation of economic life and political life.

I will now follow with a few quotes taken from Steiner’s economics course, where these technologies could prove to be useful. In Lecture 13, Steiner talks about needing to have accurate data, without morality, agitation, and politics:

The first thing necessary is that we should begin working on definite data, in order to see, in an atmosphere unclouded by prejudice and agitation, how some particular area gets into an unhealthy economic condition.

So, looking at these three network models, the centralized and decentralized networks are prone to develop biased data, they have points of vulnerability, simply because they have centralized points of friction where the egotistical moral hazard of individualities can thrive. In contrast, the distributed model offers more accurate data while also fostering an altruistic economic life in individuals.

In Lecture 7, Steiner talks about the main focus of economics being the desire to compensate for the constant natural tendency to introduce rent and industrial capital, both of which falsify prices, and that only economic associations are the suitable instrument to perceive the economy and effect change. So, the distributed network is the one offering the most fertile soil for associative economics, because, through it, one can truly associate at will, without impediments or conditions, and gain a wider perception of the state of the network, while the other two hide and hinder the flow of economic potential that exists between peers. The distributed model fosters these connections and enables peers to perceive themselves within the network.

From discourse 6, following lecture 13:

This necessitates the aging of money. It is merely a question of how to do this. Now, one can only give outer effect to the gradual devaluation of money by stamping money, the fully-stamped notes being processed by officials. But this necessitates a very complicated bureaucracy. So it is not a question of outer devaluation, but of guiding money through the real course of economic events.

Here, Steiner says that to guide the aging of money in an outer way by stamping it would have been a very cumbersome task back then, requiring armies of accountants, but that is no longer the case because that’s no longer a limitation with today’s technology. So that is now achievable. Regarding the guiding of aging money, it could also be done today using the ‘smart contracts’ that I mentioned earlier.

So, as Rudolf Steiner talked about in his discourse, we now have two technological instruments that could allow us to guide the aging of money, externally and internally. Again, that’s another untapped possibility of these technologies. Recapping, they could emancipate economic life from the centralized State and the decentralized intermediary networks, which are anti-social by nature and establish distributed networks, which would foster consciously willed connections between people.

A Side Note and Future Research

The fraternal gesture of Purchase money pairs well with a distributed network, the collegiate gesture of Loan money pairs well with a decentralized network, and the individualistic gesture of Gift money with a centralized network.

The distributed network is the most transparent, allowing you to see everything. Nothing is hidden; you can see who’s transacting. You cannot cheat, you cannot hide, and you cannot tamper with the ledgers. It allows you to see data in real-time, what’s happening at every moment, visible to everybody; nothing is hidden behind a private network, which is the tendency of the other two networks.

So in essence, distributed networks could help us regain what we lost when we abdicated economic responsibility to the rights sphere. This gives us a chance to regain some of that, in some measure, through these technological advances.

Decentralized Autonomous Organizations (DAOs)

From the push to remove the vulnerable points, also comes the DAO, which stands for ‹decentralized autonomous organization›. The need to introduce the rights sphere emerges once the necessary associations are established in the network to accomplish a task or establish an endeavor. Since there’s no defined authority in the distributed network, it’s apparent chaos calls for some kind of governance to manage it. So the DAO emerged pretty much inherently to do just that. It is a governance system where you can actually create any kind of association; basically, it’s how all these people who are participating in the network agree on running their network in a communal way. That’s basically the definition of a DAO. It gives the peers of the network free rein to establish any imaginable type of corporation suitable to them and their task at hand.

Bitcoin is a DAO; its miners are granted the right to decide how the code of the network is upgraded. Ethereum, the first smart contract blockchain, was started as a DAO in which the members also decided how it was to be run. From there on all sorts of DAOs started to appear. So people are able to establish among themselves the network, and then distribute voting rights to decide how it is to be run. It allows peers the flexibility to say, «for this situation we will appoint dictators», «for this case we’ll use direct democracy», and «for these other instances, we’ll use quadratic voting», which is a weighted way of voting. So it allows unprecedented flexibility to structure whatever governance model you want to have. It’s not set in stone, it’s adaptable to emerging situations, and only applies rules to what has been decided.

Here’s a diagram that compares a conventional top-down management structure to a DAO. On the left, you see a very structured, rigid, immutable structure of power and decision-making, whereas, on the right, you see the flatter structure of a DAO, where everybody who’s a member has a role and rights. Their role determines the weight of their rights in an equitable way. DAO members agree on which kind of governance to use for each situation, which, as I said, could be dictatorship or democracy, quadratic voting, direct democracy – any governance structure that you could come up with, could be implemented and then improved through associative consensus.

So that’s all there is to a DAO, which is fundamentally how the network is actually governed. Recently, in the last three years, some of these DAOs have been given legal entity status in the USA. In the state of Wyoming, a DAO can establish a parallel corporate entity with legal status. They are also trying this in the Marshall Islands and in some other countries like Estonia, which allows DAOs to register as an earthly, brick-and-mortar institution, similar to a corporation. Estonia has been running its entire government via blockchain for several years now. The State of Nevada has started to grant DAOs that hold pieces of land municipal status, as long as they bring significant investment to that land. Municipalities are governed as DAOs. That’s something that happened a year ago. There are now DAO cities in Nevada that let you operate this way. So, although all this has been unfolding as western democracies seek renewal, a watchful eye needs to be kept over these rapid developments, which could be fruitful or detrimental to social evolution.

An Example of an Intuitive Economic Association as a DAO

Out of all these tools, there are a few interesting examples where associative economics has emerged organically. Now I’m going to give you an example. https://www.metafactory.ai This website belongs to a DAO that’s been created by 20-30-year-olds – it brings into direct participatory association designers, producers, manufacturers, and distributors, all coming together from across the world. These folks were unsatisfied with mainstream fashion lines and decided to create their own and established a DAO to run their fashion line. They use their DAO to decide what line to produce by whom, where, and how. Producers, distributors, and consumers, all have a participatory role in the creation of their products. They have all sorts of members, some of whom work at the ‹sweatshops›, some are designers, some are distributors and many are customers.

This emerged completely organically; it took on the associative model all by itself. They leveraged decentralized finance markets to raise starting capital. Now they mint their own cryptocurrency backed by their surpluses, which they choose to invest either in fair-trading their ‹sweatshops› towards correct prices or in innovation. Again, it’s run by the consumers, the designers, and the manufacturers – everybody who’s in the chain has a direct participatory role.

They’re somewhat unconscious, yet very conscious about why they chose this approach. They’re all into the bankless ethos. They have a sold out ‹break up with your bank› tapestry and a bank-less line of clothing. But all this really originated from a very unconscious urge to break off from mainstream fashion and democratize fashion. They were frustrated, so they just grabbed these tools and created their own ‹economic association› to create the products they needed, and involved everybody – the consumer, the producer, the distributor. They act as one coherent organism, they establish their own voting right structure, and they mint their own currency. All of this would be somewhat difficult to implement using conventional methods. There are a few interesting examples of these proto-associative economic DAOs.

To close up, since all this has already happened, it would be prudent to explore if these technologies could behold, in full consciousness, Steiner’s economics course and his indications for a healthy threefold social organism. Not just merely arrive at these associations by chance, which is positive in itself, but how to use these technologies to redeem their inherent impersonality, and reinstate the necessary social interactions that could emancipate the rights sphere from the economic sphere and bring them back together in a more harmonious way.

So, that’s basically the gesture of these technologies – a potential means to cross the threshold from conflicted networks into associative networks. Voila!

Footnotes

- The Great Fire of 1834

- There was then an architect competition to rebuild. For a brief moment, a parliament in the round was in prospect, but it was decided to more or less rebuild and keep the two-sided adversarial chamber.

- In economics, moral hazard refers to a situation where someone has the incentive to increase his or her exposure to risk because he or she does not bear the full costs of that risk.

- Implying that a reserve currency (i.e. a domestic currency recognized as supranational) is valued or validated in terms of its future purchasing power, hence, ‹store of value›.

- Per Investopedia, fungible goods are items that are interchangeable because they are identical to each other for practical purposes. Commodities, common shares, options, and dollar bills are examples of fungible goods.

- Decentralized Finance, similar functionality as Trading Networks, but without the centralized brokerage firms such as NYSE, NASDAQ, FTSE, DAX.

Thank you.